Digitization of financial services: challenges and future

July 7, 2021

Banking was one of the first traditional sectors to undergo significant digitization. The first wave had to do with boosting competitiveness and getting ahead of an increasingly large pack of rivals. Despite being something of a pioneer in digitization, the sector now faces the challenge of taking it to the next level. But now, it’s not about gaining a competitive edge. Instead, it’s simply about keeping the business afloat.

SNGULAR has been accompanying banks and financial entities in the race to the future for more than 20 years. Indeed, there’s no sector where we have more experience.

Challenges of the sector

Banks are already one of the most digitized sectors, but they now face three serious points of concern in this fresh wave of digital transformation:

-Online banking apps and user experience: Banks have shifted away from serving clients in branches. This may appear convenient, but branches were staffed with trained professionals who knew clients’ names and understood the complexities of the banking system. Now, most of a bank’s services are performed on apps, which have an extremely high bar in terms of creating a good user experience, simplicity, versatility and safety. These apps aren’t entertaining games, they are for managing people’s life savings.

-Updating backend and core systems: So-called host systems, to respond to the multiple needs that have surged in response to the massive digitization since the turn of the century, are the heirs of legacy systems. Some banks even installed their first digital tools in the 1960s or 70s. These are extremely difficult to substitute as they are critical for the proper functioning of the banks. Often, strict regulation even holds this back.

-Lack of tech talent: This has been triggered by the incredible global demand and is particularly hard on banks, which have a double barrier to attracting talent. First, they can’t usually rely on junior talent since the projects require profiles that are both experienced and have a certain degree of seniority. Second, this talent that they need is particularly demanding when it comes to job offers. They often demand technical and management frameworks that are more modern than banks currently have. This becomes another cultural challenge for organizations when it comes to attracting and retaining this type of talent, which is increasingly at the core of modern business models.

User experience is now online

Banks have shifted from being places where we go to services to which we connect. Now, most individual and corporate users use the application that banks provide for everything from online banking to payments or investment. That’s why these applications have become the center of attention and investment for financial entities. With that, they face various challenges:

-The first and most visible is the user experience of these applications. Unlike bank employees, average users don’t have any specific training on how to use these bank services, which is why the interfaces should facilitate the operations for these clients. But that alone is not enough. Modern clients are used to using applications for many different purposes, so they will be able to tell the difference between good visuals and interfaces and bad ones. A bad mobile app is equivalent to an old, dirty banking branch full of incompetent employees. On the flip side, those that offer new and convenient services will gain more traction and customer retention, both of which are vital in this highly competitive market.

-Users have gone from understanding physically going to banks as a necessary part of their lives to something that is an unnecessary burden. In this sense, applications face the challenge of offering online end-to-end services with operations that can be started and finished on the same device. This doesn’t just refer to classic transfers and payments but also to more elaborate processes like signing up for a new account, taking out loans, mortgages, etc. These processes may need to rely on sending and checking documentation or validating a user’s identity.

-Of course, these users demand applications that allow them to do everything easily in a digital environment that’s modern and attractive. They also want to do it from anywhere, any device and at any time. This obligates banks to offer multichannel solutions that are adapted to computers, smartphones, tablets, smartwatches, TVs or smart assistants. These each have their own ecosystems, operating systems or run environments and security considerations.

-To everything, we also have to add the demand of accessing these applications quickly and with agility. This applies just as much at midnight as it does at the highest traffic times of the day and forces banks to have systems that are highly available and scalable, with high traffic support when users reach record levels.

-The financial ecosystem is no longer exclusive to classical entities and is increasingly full of applications and services that come from new competitors. These competitors range from tech giants like Google and Apple to startups and other sectors that have traditionally mobilized large sums of money like retail or insurance. This opens the door to associations, cross-selling, or novel integrations with third-party applications. But these moves should be considered carefully in terms of value offers and service design, since they present more technological challenges when it comes to interconnectivity between different organizations.

-If all that wasn’t enough, another of banks’ top challenges in terms of user experience is being able to implement the best security and safety measures, both for themselves and clients, in experiences that are as unobtrusive as possible. They should minimize friction without compromising on safety. This apparent contrast has given rise to the security UX design, which aims to make all of these security measures as invisible as possible.

When your business evolves faster than your technology

When it comes to core systems, the challenge is highly complex and must be dealt with on multiple fronts:

-Core systems are absolutely critical, which is why you can’t disrupt their operations and any update requires major precautions and extreme security. This turns updates into arduous and costly projects. The perceived risk is high and there are possibilities that anything going wrong could become traumatic for the organization.

-These core systems are often based on legacy technology, which is a challenge to maintain and integrate with modern infrastructure and architecture. This also adds another layer of difficulty when it comes to finding talent, as experts in this legacy technology are not easy to come by.

-In the core of international, or even national banks, you’ll tend to find multiple host systems, which are extremely diverse and sometimes incompatible with each other. This is due to many fusions and acquisitions of different types of entities. And each of these systems may have different geographies and were designed according to different needs, philosophies and customer types. They should be serving different segments even though they all belong to the same bank.

-The load on these systems and the complexity of operations have increased even sometimes beyond the most optimistic projections of the original system developers. Instead of serving thousands of employees, they need to serve hundreds of thousands or even millions of clients.

-The expectations of modern clients (in terms of immediacy, speed, end-to-end, integrations with multiple services or systems) have overwhelmed the capacities of the existing systems. These systems are limited by the current technology and require the implementation of state-of-the-art solutions that allow them to constantly and immediately run operations, synchronize and update.

-The interconnections with foreign systems are increasingly complex. The demands of the market, and even regulatory demands, oblige banks to have services that can be consumed beyond their apps, through APIs that allow other entities or third-party applications to connect and operate with them.

-Last but not least we have the challenge of security, which is increasingly key both due to the strict regulation that the banks have to comply with and increasingly sophisticated cyberattacks and threats. This means their cybersecurity must also be state-of-the-art.

Talent is a scarce resource

If the technological challenges weren’t enough, banks also face the massive challenge of finding and retaining human talent. All of these new technologies require trained professionals. These professionals are rare and companies of all kinds are competing for them.

Capturing this talent is a complex problem. It demands much more than just paying higher wages, as these professionals have the ball in their court and can demand a series of non-monetary conditions that may clash with a company’s culture — a flexible schedule, remote work, agile methodologies or even that the company’s reputation matches with their ideals or interests.

And the challenges don’t stop there. Once they’ve come on board, it’s extremely important to retain them, which may be even more difficult, especially when they’re highly experienced and have a deep knowledge of the sector. This knowledge and experience becomes increasingly valuable for both the bank they are working for and the bank’s direct competitors. If these people get bored, become unhappy or feel like changing, they can easily permit moving since they’re in such high demand.

In any case, the amount of work that financial entities have to put into attracting, taking care of and retaining talent is a challenge far greater than what they’ve faced in the past in terms of human resources.

More than two decades working alongside banks.

The more than 20 years that we’ve spent helping financial institutions overcome their technological challenges have given us the opportunity to work on a huge range of different solutions.

Our Scalable Platforms teams have worked on numerous projects across the international banking spectrum. They’ve developed or collaborated in the development of more than a dozen online and mobile banking channels in Spain, the US, and Latin America; on projects and initiatives like onboarding and sign-up platforms; financing solutions like getting loans online; and the rest of the commercial stack including national and international payments, debit and credit cards, risk management, mortgages, personal and small business loans, corporate and institutional banking, asset management and Fintech.

This wide variety of services has allowed us to put all of our capacities into practice such as front and back architecture development, end-to-end solutions and cloud migrations. We’re also experienced in holistic project development that runs from ideation to product and service design, user experience, architecture and design, setting up cloud infrastructure, deployment and acting as consultants on pre-existing initiatives (whether technological or methodological). Whatever we do, we always adapt to the specific needs of the projects and the idiosyncrasies and business needs of the client.

This experience has given us a valuable perspective, which combines our technological expertise with knowledge of the financial sector. We have faced the challenges we’ve mentioned on many occasions and tackled them from all areas, from the layers of integration with the bank cores or ESBs to the definition of the user experience and the development of the interfaces, from architecture to the agile monitoring of the teams. No matter the project, we always work hand in hand with the client's stakeholders, both business and technical.

An amazing journey

We’ve learned so much from this amazing journey we’ve been on. It’s been long, but it continues to surprise us every day. We’ve moved from the digitalization of classic businesses to a new world where whole new lines of businesses must be created for traditional companies to stay competitive. Technological challenges kept us on our toes as well, as the sector has gone from an abrupt transition from models based on monolithic cores and batch processes to real-time models, where a user operation can trigger an immediate cascade of actions (security checks, cross-selling, trend identification, behavior prediction, etc.). These models now require the implementation of cutting-edge event-based microservice architecture on public or private clouds, with scalable systems that can handle traffic volumes that were unthinkable just five years ago or integration with multiple third-party systems (payments, transfers, eCommerce, Middleware, CRMs, etc.).

But many of the most exciting moments have been behind the scenes, accompanying banks as they shape and launch their DevOps teams, their continuous integration systems, the definition of their development and governance processes, good practices, and so on. Creating highly efficient teams and processes that can not only develop all the applications required to compete in this hyperconnected world, but maintain them, keep them safe and functioning perfectly.

Cutting-edge technological solutions

All of this learning has helped us design, develop and deploy innovative solutions that solve many of the problems that our clients are facing. One of the best examples is our “Data Acceleration Architecture.”

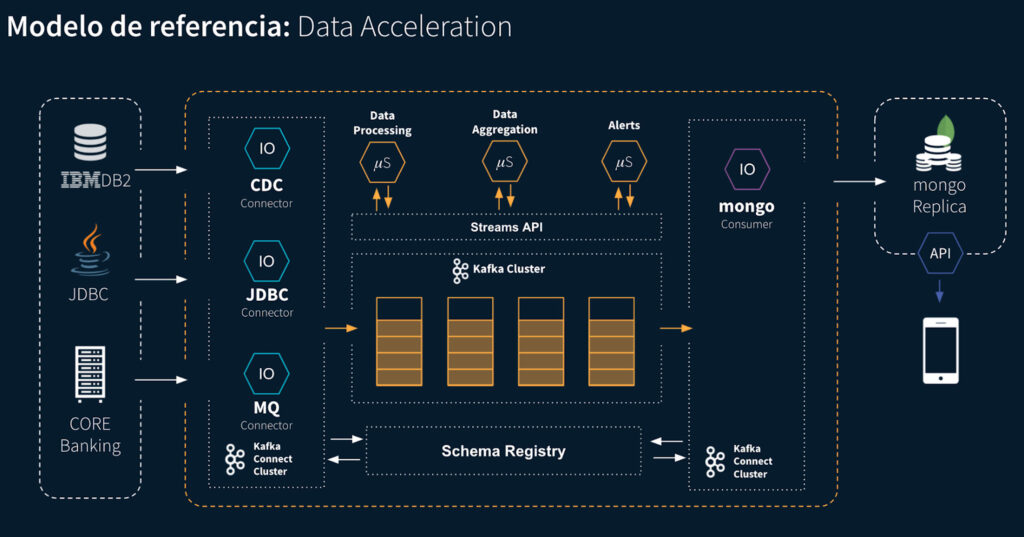

This is a model of reference for data architecture (Data Acceleration), which uses a layer of services to deliver the functionality and agility demanded by users to digital channels.

This is a model of reference for data architecture (Data Acceleration), which uses a layer of services to deliver the functionality and agility demanded by users to digital channels.

This architecture helps overcome the inherent limitations of typical backend technology in the financial sector (core mainframes). It autonomously solves query operations, downloading to the mainframes and allowing access to information in near real-time to generate data-derived competitive advantages.

We implemented this architecture on Open Source and Big Data technology. This method allows us to adapt to all types of infrastructure models (private cloud, public cloud, hybrid) and naturally fit with microservice architecture and/or events.

Core modernization

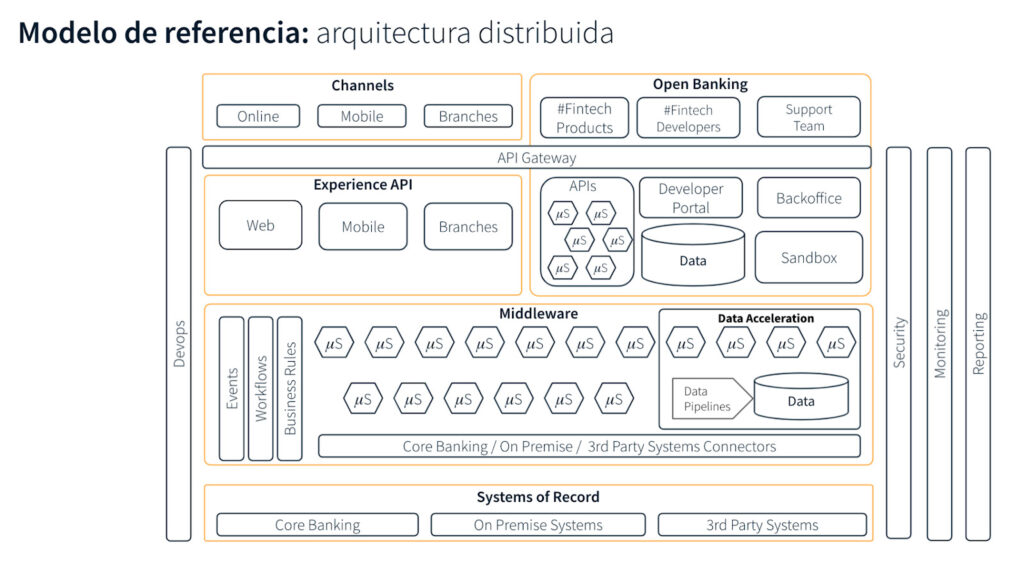

Another of our highly demanded solutions is our event-based architecture. It’s particularly desired by complex global organizations that need to modernize their IT infrastructure to improve the quality of their operations and processes over the long term.

In it, we’ve defined and implemented microservice architecture that can replace their legacy systems with an iterative approach that does not imply a traumatic change or interruption to daily operations.

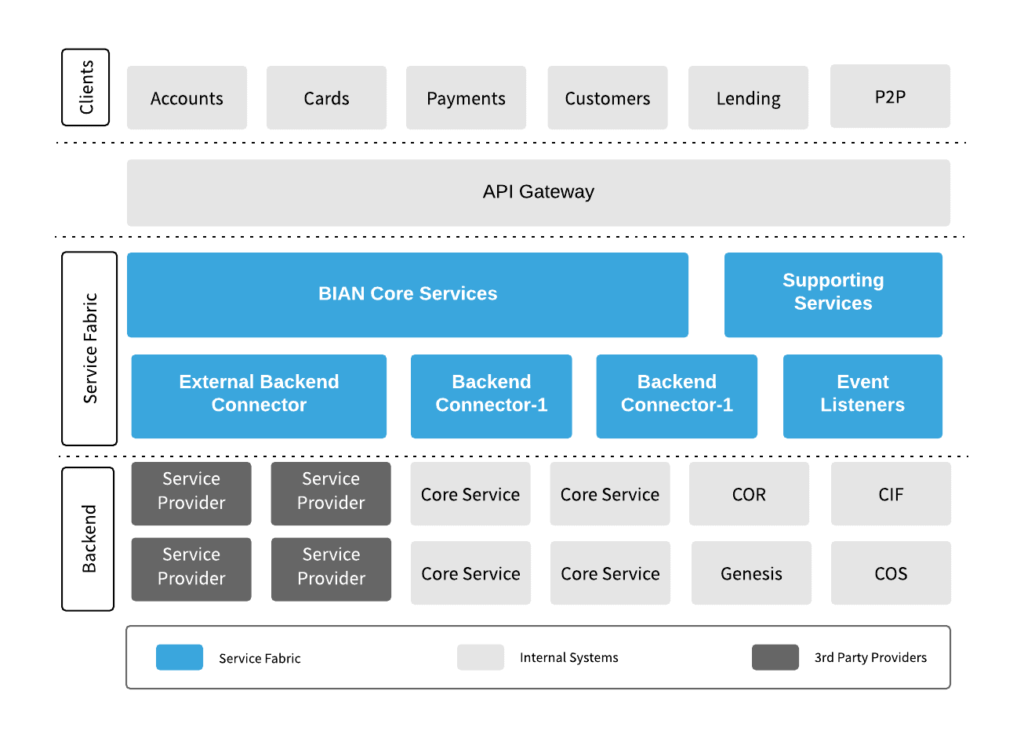

These three-layered API Rest architectures are based on the CQRS pattern and serve to boost speed and reduce costs. These three layers include communication with the host’s backend systems, the orchestration API and a series of services to integrate third parties. They are fully event-driven, built on Kafka as an intermediary and MongoDB as a database.

These three-layered API Rest architectures are based on the CQRS pattern and serve to boost speed and reduce costs. These three layers include communication with the host’s backend systems, the orchestration API and a series of services to integrate third parties. They are fully event-driven, built on Kafka as an intermediary and MongoDB as a database.

We also implement a middleware solution based on Akka’s Actor model to manage the integration of services and RabbitMQ as an event intermediary. Sometimes, when designing this type of platform, we follow the BIAN Service Fabric Layer recommendations, the new standard for international banking, through REST APIS and implementing pre-existing BIAN interfaces or creating new ones when needed.

You don't have to sacrifice design for technology

You don't have to sacrifice design for technology

We can’t forget about other types of solutions that help us improve user experience while simplifying and decreasing the costs associated with the design of corporate applications. This requires a Design Ops approach based on Design Systems, which was invented to solve the financial industry’s particular needs, with ever-expanding application ecosystems.

This approach allows us to combat the problems of reduced speed and a loss of time and money triggered by the interaction (integration/handover) between design and development. It also ensures a unified user experience and can dramatically reduce the time and money spent on designing processes and maintaining old developments.

This approach allows us to combat the problems of reduced speed and a loss of time and money triggered by the interaction (integration/handover) between design and development. It also ensures a unified user experience and can dramatically reduce the time and money spent on designing processes and maintaining old developments.

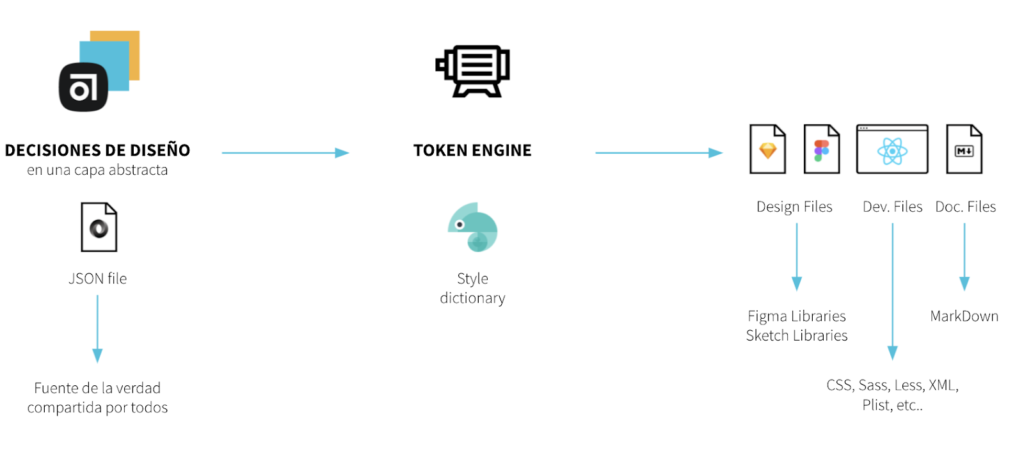

The design systems are based on components (reusable pieces of the interface) that are distributed on the design and development teams. At SNGULAR, a Token Engine is a key piece of our design system**,** which transforms the design components into assets that the developers use in their code.

The big advantage of Design Tokens is that they structure data, which makes it possible to automatically transform them into other data structures like design libraries, development components or markdowns for documentation.

The journey continues

It’s been an exciting journey so far, and the best part is that it has no signs of stopping. Each day, we are presented with challenges that are more interesting and have the potential to do incredible things, always stretching the boundaries of what’s possible. The game is more complicated, with more actors, regulations and risks. But at SNGULAR, we’re happy to navigate it alongside our clients and, in the process, help them develop the bank of the future.

Our latest news

Interested in learning more about how we are constantly adapting to the new digital frontier?

Insight

February 26, 2026

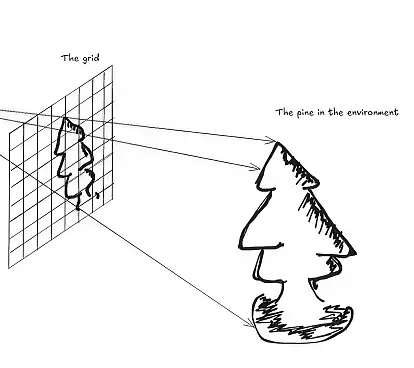

Ray Tracing, a quick look at what it is and the math behind it

Insight

February 5, 2026

Infinite Worlds: When the best graphic is your imagination

Insight

December 26, 2025

Ferrovial improves heavy construction efficiency with ConnectedWorks

Event

November 24, 2025

White Mirror 2025: the blank mirror reflecting what is yet to come